Our Investment Approach

In order to identify high quality emerging businesses that contribute to the mitigation of climate change, Emit Capital combines a top-down thematic approach with a fundamental bottom-up analysis process.

Thematic Screening

The core theme of our investment philosophy is focusing on global equities that contribute to reducing climate change. This core theme sets the foundation for the top-down sector and industry selections.

Specifically, we focus on the following sectors/business models:

Energy Transformation

Transport & Infrastructure

Energy Efficiency

Water Management

Critical Minerals

Carbon Metrics

The goal of net-zero investing is to set an emissions budget for your portfolio and to use it to achieve a 1.5°C temperature scenario.

Capital allocation and active ownership can influence companies' directions, impacting their decarbonization pathways and reducing GHG emissions both at portfolio and global level.

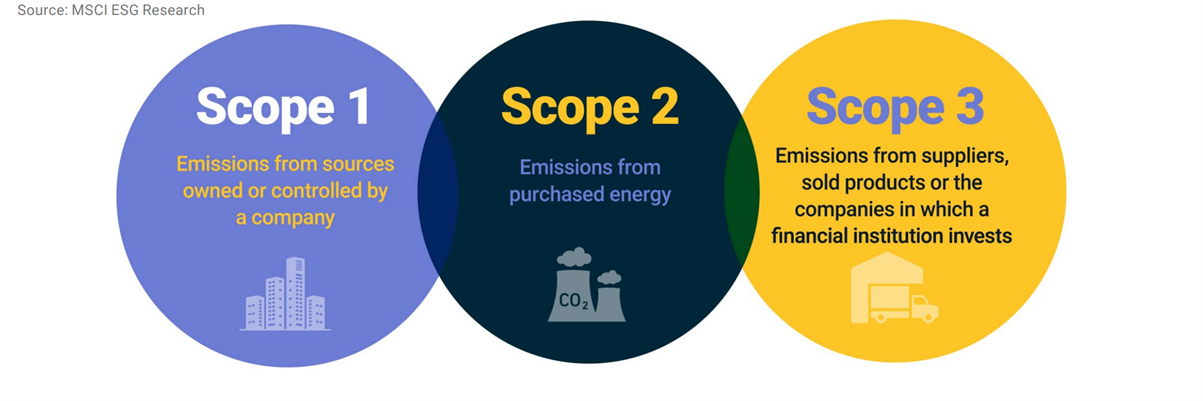

GHG emissions can be classified into three scopes under the Greenhouse Gas Protocol:

- Scope 1 emissions are direct emissions from sources owned or controlled by the company.

- Scope 2 emissions are indirect emissions from the production of electricity purchased by the company.

- Scope 3 emissions are indirect emissions that occur in the company's value chain and are not included in Scope 2, such as emissions from suppliers or from sold products.

Emit Capital utilise industry standard data to quantify the emissions of each investee company according to this framework. In most cases Scope 1 + Scope 2 data is available with Scope 3 proving more problematic.

Our carbon metrics then provide the ability to measure our portfolio of investments against benchmarks around the world to determine the optimum allocation based on our climate finance goals.

Impact Values & ESG

A secondary layer of our thematic screening involves the analysis of our invest companies with respect to ESG principles and Impact Investment values. Each company we assess must meet certain minimum requirements, including positive and negative screening, and overall scorecard.

This additional analysis provides the ability to refine our portfolio to meet important social and governance outcomes such as human rights related to investee value chains.

QUALITY, VALUE & MOMENTUM

Quantamental

Unlocking Investment Insights: A Comprehensive Analysis of Multiple Factors Shaping the Future

-

Momentum

Companies exhibiting impetus for growth are generally favourable candidates

Risk-adjusted asset performance

Independent Analyst changes in appraisal/ratings

The evaluation of each element is continually reviewed and adjusted.

-

Quality

Resilient companies proven to navigate challenging circumstances

Consideration of balance sheet leverage, revenue growth, earnings growth volatility, and expected return on invested capital/equity

-

Value

Analysis of how revenue ultimately becomes dividends: cashflow yield, earnings yield, dividend yield

Economic Value Added adjusted book/price accounts for cost of capital

-

Decision Making - Rising Stars

The factor ranks for momentum, quality and value provide a subset of stocks from which we determine portfolio holdings.

These ‘Rising Stars’ are continually assessed with no guarantees of a place in the portfolio

We continue to explore these top-quintile stocks and access for exciting future growth and opportunity.

NOT EVERYTHING THAT COUNTS, CAN BE COUNTED

Fundamental Analysis

We conduct a fundamental bottom-up analysis using qualitative and quantitative analysis based on our industry and sector analysis.

Our focus is on growth in earnings, with an emphasis on sustainable opportunities and the ability to leverage underlying business cases.

Market Risk Management

In our portfolio, we implement a hands-on risk management process to avoid missing upside opportunities, as well as to minimize downside risks.

Elements of our risk management process include exposure limits and concentration limits, buy and sell (exit) strategies including stop loss management as well as sector and regional exposure management.

We embrace volatility in our portfolio but also manage it within defined limits at individual company and portfolio level.